- This is a brief documentation for the Gann Square of Nine Excel. Gann Square Of Nine: Excel Template. The formula is essentially a reverse calculation of. Excel gann square of nine calculator free downloads, explaining the square of nine, football squares 4 winner squares, football squares template 25 squares - software.

- GATE provides a Calculator to calculate Dates based on the Gann Emblem for your selected Target Date GATE calculates the Time of an exact Square and checks if turns occur on a repeat of the cycles from the Birth of the Contract or a Date you choose (typically a strong top or bottom). GATE creates the Square of 9 highlighting past Swings.

- The ideal time is 15min - 1hr after market opens. The GANN square of 9 is a 9×9 grid. There is a “start number” and defined increments from this “start number” ultimately create the spiral square. This theory is mainly used in an intraday calculator and is very easy to use.

- Check EXCEL Intraday Trading using W.D. GANN Square Of Nine method. Gann's Square of 9 (Nine) Calculator Select Your Currency Enter Current Market Price Gann Square of 9 Recommendation: Buy At / Above Stoploss Sell At. 9,GANN calculator,gann method,gann method of day trading,day trade using gann method,swing trade using gann method,WD GANN.

Interested in Trading Risk-Free?

Build your trading muscle with no added pressure of the market. Explore TradingSim For Free »

Intraday Trading using Gann square of 9 Calculator Gann square of 9 calculator is used to generate support and resistance levels for intraday trading. The supportresistance levels are generated using the values in Gann square.

Gann

Who is Gann?

The trading concepts used by William Delbert Gann, or W.D. Gann as he is fondly called, bring feelings of intrigue and mystique.

He is primarily known for his market forecasting abilities, such as the Gann square of nine which combine a mix of geometry, astrology, and ancient math techniques. Gann started trading at the age of 24 and was a religious man.

Gann was also a 33rd degree Freemason [1], to which some attribute his knowledge of mathematics and ratios.

For the most part, Gann’s works have been open to interpretation. Therefore, to trade based on Gann’s methods requires extensive practice and understanding.

Understanding Gann

Unlike trading with technical indicators where you can buy or sell when some variables are met, trading with Gann’s methods is not as straightforward. This is because learning the methods takes time. You can’t just apply a few moving averages to the chart and give it a go.

The other challenge is there are no clear Gann trading strategy experts to learn from. So, why are traders still holding on to techniques defined in the 20th century?

My take is that it’s so complex and hard to decipher, this leads traders to believe there must be something there.

Among the many trading methods known to Gann, the square of nine is quite popular.

What is the Gann Square?

Squares, circles, and triangles are the three most common geometric shapes that form the basis for most of Gann’s work.

Gann’s wheels and squares are some of the most common applications and form the cornerstone of Gann’s work.

For example, Square of nine, Square of 144 and the Hexagon are some of the many works from Gann that are popular.

Square of Nine

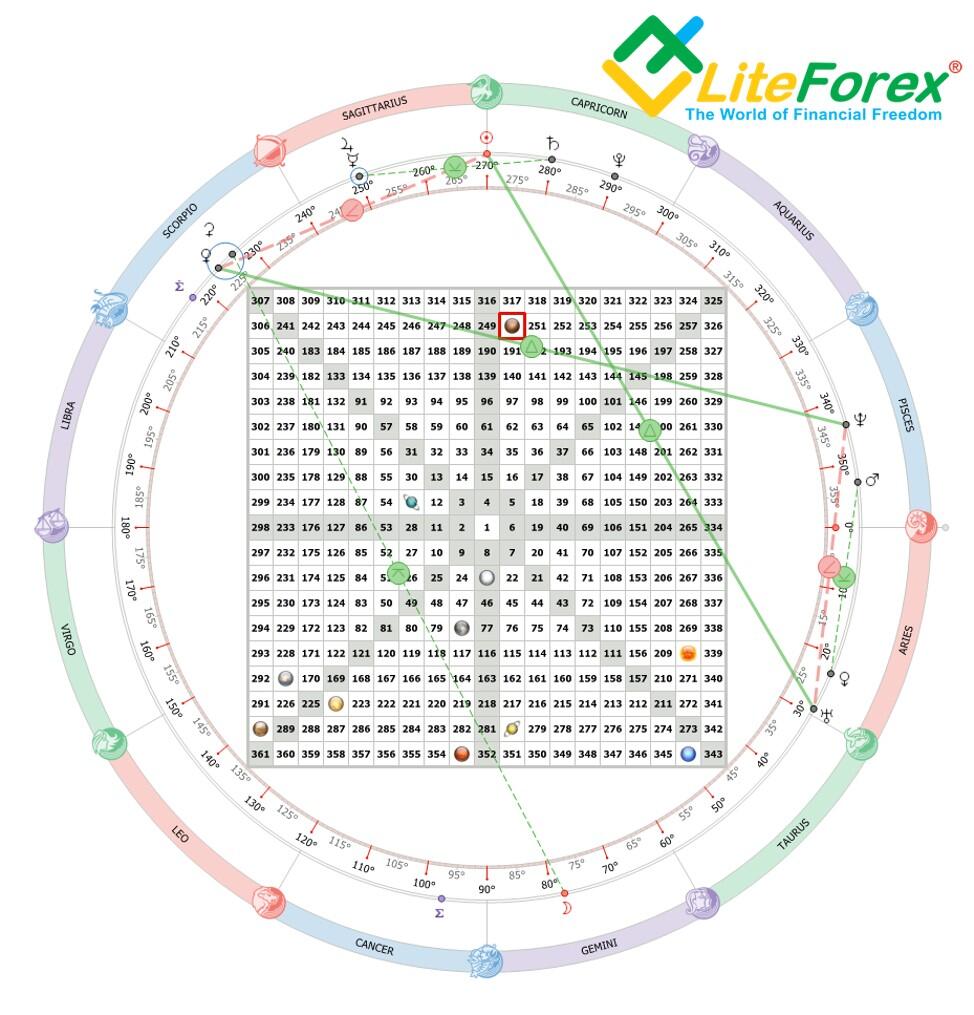

The square of nine or Gann Square is a method which squares price and time. The Gann square of nine gets its name because if you look at the above chart again, the number 9 represents the completion of the first square.

The square of 9 is a spiral of numbers with an initial value “1” starting at the center. Starting from this value, the number increases as we move in a spiral form and clockwise direction. According to experts, each cell in Gann’s square of nine represents a point of vibration.

How to Calculate the Square of Nine

The numbers within the Gann square of nine also follow a certain harmonic pattern. For example, when you take a number, such as 54 from the above square, the value to the next of it (to the right), 29, is derived as follows:

The square root of the number and subtract 2, and re-square the result.

Ex: 54 is the original number

The square root of 54 = 7.348469

7.348469-2 = 5.438469

(5.438469)2 = 29 rounded off

To determine the value to the left, instead of subtracting 2, the number is added. So, we simply add +2 to the square root of 54 (7.348469), bringing the value to 9.348469. We then square this result to get a value of 87.

How does the Gann Square work?

The Gann square of nine helps to identify time and price alignments in order to forecast prices.

In the Gann Square of nine, the key numbers of importance are as follows:

- 0 or 360 degrees: 2, 11, 28, 53….

- 45 degrees: 3, 13, 31, 57, 91…

- 90 degrees: 4, 15, 34, 61, 96…

- 180 degrees: 6, 19, 40, 69…

Cardinal Cross and Ordinal Cross

The next sets of important numbers fall within the cardinal cross and the ordinal cross.

The picture below shows the cardinal cross, represented in the blue horizontal and vertical lines. The ordinal cross numbers are represented in the yellow cells.

The numbers that fall in the cells represented by the cardinal and ordinal cross are key support and resistance levels.

While both are important, the ordinal crosses are of less significance and can be breached at times.

Gann Square – Cardinal and Ordinal Cross

The most important numbers as we know it occurs every 45 degrees on nine chart.

Each degree is a representation of time.

Above is a standard 1×1 chart. As an example, if price made a high of 54 on the day, if price retreats, the next support is 29, as it is the next closest number across the square of nine.

Circle Around the Square

Also, drawing a circle connecting the four corners of the squares brings the concept of angles into perspective. The angles, measured by degrees can point to potential support and resistance levels when the price is said to be moving within an angle.

The chart below shows the Gann square of nine with the circle plotted around it.

Gann Square of nine with the circle, introducing angles and degrees

Using the Gann Square

To use the Gann chart, simply replace the starting number 1 with a number of your choice and the desired step value. In the above example, the increment is 1, but you could use larger or smaller values.

The resulting numbers in the ordinal and cardinal number cells are key resistance and support levels.

Based on this information, traders can look to either buying or selling into the nearest support or resistance level.

Gann’s square of nine also factors in planetary movements and the degree of price movement based on the circle.

There is a big difference between forecasting prices and trading. For example, one can forecast that the Emini S&P500 will rise to 2100 within a certain period of time. What the forecasting won’t tell you is whether the move to 2100 will be straight, or if the price will fall by a significant number of points before rising to 2100 and so on.

These might seem insignificant when it comes to forecasting, but they can be very things that can define a successful or a bad trade.

Additional Resources

To go deeper on Gann trading strategy, check out this awesome interview covering Gann and swing trading. The video is close to an hour and provides additional insights you can use to help develop a Gann trading plan.[2]

Lastly, if you are looking for original Gann teachings, please visit https://www.wdgann.com/. This is the site for WD Gann, Inc. which according to their site, purchased the original Gann writings from his business partner Ed Lambert in the 1970s. [3]

External References

Gann Square Of Nine

- William Delbert Gann. Wikipedia

- Aaron Fifield, Walker, Tim. (2015). Gann Swing Trading & Technical Analysis. [Video]. YouTube.com

- About Us. WD Gann, Inc.